Central banks the world over continued their gold shopping for spree this yr, including 290 tonnes within the March quarter, whilst document excessive costs hit client demand.

- Additionally learn:Gold soars on geopolitical dangers, central financial institution shopping for

Actually, central banks accounted for 23 per cent of the general gold demand at 1,238 tonnes within the March quarter.

Jewelry consumption in India was up 4 per cent, within the March quarter at 92 tonnes in opposition to 85 tonnes in the identical interval final yr.

The central banks have accelerated their wager on the yellow steel and accounted constantly for nearly 1 / 4 of annual gold demand within the final two years.

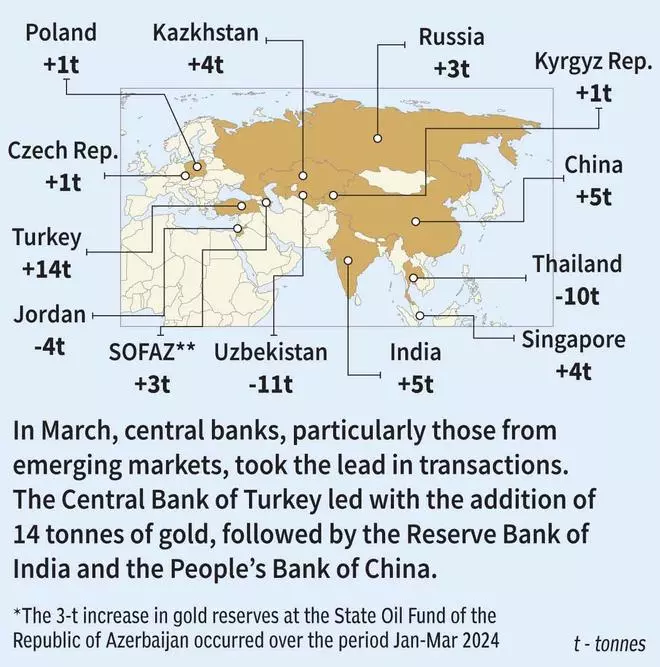

In March quarter, 10 central banks added gold with India shopping for 19 tonnes whereas Central Financial institution of Turkey and Folks’s Financial institution of China bought 30 tonnes and 29 tonnes.

RBI stepped up shopping for gold since 2008 and bought 200 tonnes in 2009 in the course of the world monetary disaster.

This marks the seventeenth consecutive month-to-month improve, serving to central banks elevate their reported gold holdings to 2,262 tonnes, about 16 per cent greater than as of October, 2022, after they resumed reporting month-to-month additions, stated the World Gold Council.

Other than greenback weak point in opposition to main currencies, the massive gold shopping for by the central banks have been driving the yellow steel costs.

Gold costs have elevated 10 per cent to $2,070 ($1,860) an oz., within the March quarter, whereas, it was up 8 per cent to $1,940 ($1,800) in 2023.

Rattled by the geo-political developments and disturbed by a slowing world economic system, the central banks have been hedging their danger by rising the gold element of their foreign exchange reserves, regardless of costs hitting a document excessive.

Curiously, the central banks of Turkey, China and India, have been main from the entrance in including gold to their foreign exchange reserves.

Madan Sabnavis, chief economist, Financial institution of Baroda stated RBI is strategically rising gold reserves as a part of its foreign exchange diversification efforts and a serious portion of RBI reserves are in greenback aside from different currencies.

Gold is the most effective hedge in opposition to the greenback because it goes up when the greenback depreciates, he added.

With the current surge in greenback volatility and the upward trajectory of gold costs, the transfer not solely enhances the steadiness of international change reserves, but additionally makes it a prudent monetary determination, stated Sabnavis.

- Additionally learn:Who’s been fuelling the brand new gold rush?

Sachin Jain, Regional CEO India, World Gold Council stated the central banks’ gold purchases usually are not influenced by rising costs, although, a few of them might take a pause relying on their technique.

Whereas many central banks’ ongoing voracious urge for food for gold has been one of many key drivers of its current efficiency within the face of seemingly difficult circumstances together with greater yields and US greenback energy, he added.