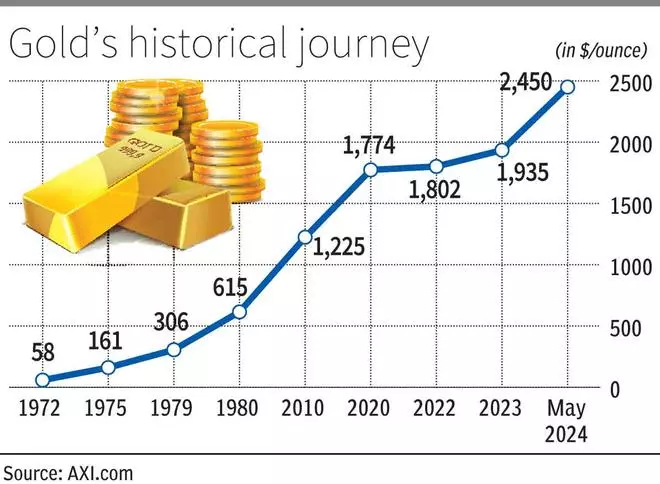

After declining about 5 per cent since hovering to a brand new excessive of $2,450 a troy ounce (oz) final month, gold costs will seemingly come below stress this quarter. China pausing its gold purchases, the US labour market trying robust and indications of worldwide rates of interest remaining excessive will drag the yellow metallic, say analysts.

“We anticipate gold costs to return down barely from their present ranges this quarter because the Fed continues its cautious strategy, and with geopolitics already being factored into the present worth,” mentioned Ewa Manthey, Commodities strategist, ING Assume.

Value forecast

ING Assume, the monetary and financial evaluation wing of Dutch multinational monetary providers agency ING, mentioned it sees costs averaging $2,300/ozwithin the second quarter and an annual common of $2,255 in 2024.

“We see costs peaking within the fourth quarter, averaging $2,350/ozon the idea that the Fed begins slicing charges within the second half of the yr and the greenback and yields weaken,” mentioned Manthey.

Zurich-based personal banking company Julius Baer’s analysis staff mentioned whereas chasing gold has been one of many favorite pastimes of worldwide traders yr up to now, “from a pure worth perspective, we nonetheless see extra draw back than upside within the medium to longer-term”.

Saish Sandeep Sawant Dessai, analyst, Angel One, mentioned gold costs dropped practically 3 per cent final week, marking their third consecutive weekly decline. The autumn was triggered by a stronger-than-expected US jobs report, which dampened hopes for rate of interest cuts this yr.

Fairly operation

On Tuesday, gold was quoted decrease at $2,305.90/oz. In India, the yellow metallic on the Multi Commodity Trade (MCX) dropped by ₹160 to ₹71,275 per 10 gm. In Mumbai, the spot worth for 24-carat gold (.999 fineness) was ₹7,119 a gm and 22-carat jewelry gold was ₹6,521.

The dear metallic’s decline was pushed by China halting bullion purchases in Could, based on the FXEmpire.com web site. “A stronger-than-expected US labour market, suggesting US rates of interest could stay excessive longer-than-anticipated. These elements elevate questions on gold’s worth with out China’s assist,” it mentioned.

Gold’s latest rally, lasting for months, was attributed to aggressive central financial institution shopping for, primarily China. The stalling of the yellow metallic’s surge has led to hypothesis that central banks are nonetheless shopping for, stopping or reserving income.

“Not like high-profile traders who publicly focus on their trades, central banks function quietly, leaving markets guessing their subsequent strikes. This uncertainty has turned long-term bullish traders into short-term merchants, growing market volatility,” mentioned FXEmpire.

Robust US knowledge

Jateen Trivedi, V-P Analysis Analyst-Commodity and Foreign money, LKP Securities, mentioned the potential for sustained increased rates of interest is weighing on gold.

“Robust non-farm payroll knowledge boosted the greenback index to 105, additional pressuring gold costs. Moreover, revenue reserving and issues over China probably halting gold purchases are contributing to the present weak point in gold,” he mentioned.

Angel One’s Dessai gold costs will more likely to proceed their decline. Julis Baer’s analysis staff mentioned from a portfolio perspective, gold stays a hedge in opposition to financial and systemic dangers in monetary markets, akin to an additional weaponisation of the US greenback.

ING Assume’s Manthey mentioned Could’s stronger-than-expected US jobs report has pushed again expectations on when the Fed could begin slicing charges. “Decrease charges sometimes increase gold, which doesn’t pay curiosity,” she mentioned.

Fading urge for food

ING Assume’s economists suppose the US Fed may push its projections for a fee cutback in order that they may find yourself with two cuts in 2024 and 4 cuts in 2025 slightly than three cuts in 2024 and one other three in 2025.

On China, she mentioned China’s urge for food for gold began to fade in April, when the Folks’s Financial institution of China purchased solely 60,000 oz, down from 160,000 ozin March, and 390,000 ozin February. Gold’s record-breaking rally may dent demand for now.

Manthey mentioned investor holdings in gold ETFs (exchange-traded funds) usually rise when gold costs acquire, and vice-versa. Nonetheless, holdings have declined for a lot of 2024, whereas spot gold costs hit file highs till ETF flows lastly turned constructive final month.