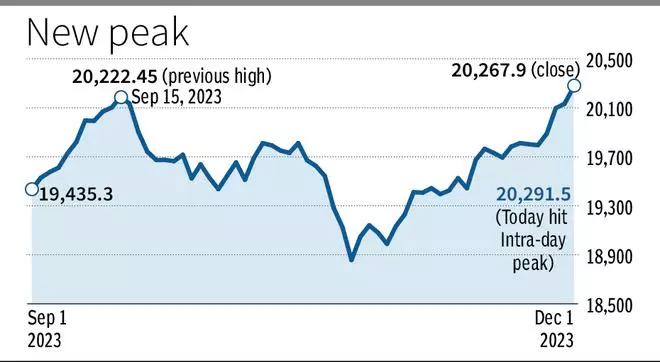

The benchmark 50-share Nifty surged to a record high on Friday on the back of better-than-expected GDP numbers, buying by foreign investors and positive global cues.

Nifty rose for the fourth straight session to close at 20,267, up 135 points or 0.67 per cent, and register its fifth consecutive weekly gain. The Sensex rose 0.7 per cent to end at 67,481.

All sectors, except auto, ended in green, with FMCG, financials, realty and PSU banks the top gainers. Defense stocks were in focus after government approved ₹2.23-lakh crore defense acquisition projects. ITC (3.2 per cent) and NTPC (2.9 per cent) were the top Nifty gainers.

Advantage India

India remains a bright spot in an uncertain global economic environment, with a better-than-expected year-on-year GDP growth rate of 7.6 per cent for the September quarter. The country’s manufacturing sector activity continued to expand in November, with the S&P Global Purchasing Managers’ Index rising to 56.0 from 55.5 the previous month.

External factors such as falling US bond yields, easing inflation and potential Federal Reserve rate cuts next year also kept the markets in good stead.

Also read: Tata Technologies blockbuster listing: Why IPO investors can’t have the cake and eat it too

“Indian equities gained for the fifth consecutive week driven by strong economic data, healthy corporate earnings and cheerful festive season. Return of FPIs, multiple upgrades of India’s economic growth by global firms, added to the overall positivity,” said Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services.

FPIs bought shares worth ₹1,589 crore on Friday, provisional data showed. The investors turned buyers in November after two months of selling, shopping for equities worth over $1 billion.

“The capex by the government and the pick-up in manufacturing activity, led the capital goods and infra stocks to outperform. The global market, too, rallied on hopes that the ECB has completed its rate-hiking cycle on the back of easing inflation and ahead of the FED chair speech today. Oil prices continued to move loser despite the OPEC+ supply cut, which will support the H2FY24 operating margins of the corporations. The auto sales numbers witnessed a festival cheer, while the premium valuation restricted the upside potential,” said Vinod Nair, Head of Research at Geojit Financial Services.

Also read: Should your IPO investment be based only on grey market premium?

Asian indices traded mixed on Friday, with the Hang Seng and Kospi slipping by more than 1 per cent each. European indices were trading in the green.

There is no indication of any reversal pattern unfolding at the highs for the Nifty, which formed a long bull candle on the weekly chart.

“The short-term trend of Nifty continues to be positive, and one may expect further upside in the coming week. The next upside levels to be watched is around 20,510, with immediate support at 20,140,” said Nagaraj Shetti, Technical Research Analyst, HDFC Securities.